The high net-worth individual surge

High-net-worth individuals are voting with their feet. Global wealth reports continue to show rising cross-border mobility among affluent Americans, driven less by wanderlust and more by taxes, optionality, and downside protection. For earners anchored in NYC’s combined state and city tax burden, geo-arbitrage has evolved from a nomad experiment into a strategic wealth blueprint.

In 2026, the question isn’t whether to arbitrage — it’s where. Panama and Cyprus represent two of the cleanest, most defensible paths for Americans looking to reset costs and taxes without relying on loopholes. One is built on territorial taxation and affordability. The other offers EU residency with a powerful non-dom tax framework.

NYC’s $5,500+/month lifestyle versus Panama’s $2,000 or Cyprus’ $2,500 isn’t just a cost gap — it’s a compounding advantage. Add smarter tax positioning, and geo-arbitrage can unlock tens of thousands per year for reinvestment, FIRE acceleration, or simply breathing room. Let's arbitrage it right.

Practical guide

Tax basics

Not financial advice; consult a licensed pro (e.g., via Greenback Expat Tax) for your situation.

U.S. citizens remain subject to worldwide taxation, regardless of where they live. Geo-arbitrage doesn’t erase the IRS — it restructures exposure through legal frameworks like the Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credits (FTC), while reducing or eliminating local taxes abroad.

The strategy hinges on pairing where income is earned, where residency is established, and how local tax systems treat foreign income.

Foreign Earned Income Exclusion (FEIE) & Form 2555

The FEIE allows eligible Americans abroad to exclude up to $126,500 of foreign-earned income (2025 limit, indexed annually) from U.S. federal taxation.

Qualify via:

Physical Presence Test (330+ days abroad in any 12-month period), or

Bona Fide Residence Test (full tax year overseas)

Applies to: wages, salaries, self-employment income

Does not apply to: dividends, capital gains, pensions

Why it matters: For many remote professionals, FEIE alone can shield the majority of earned income from U.S. federal tax.

Foreign Tax Credit (FTC) & Form 1116

The FTC offsets U.S. tax liability using taxes paid to foreign governments, but cannot be applied to the same income excluded under FEIE.

Best used when foreign tax rates exceed U.S. effective rates

Common for EU jurisdictions with structured local taxation

State taxes & reporting obligations

Escaping U.S. state taxes requires more than time abroad. States like New York and California apply domicile and intent tests, not just day counts. Cutting ties — housing, voting, driver’s license, primary residence — matters.

Foreign bank accounts exceeding $10,000 aggregate require FBAR reporting annually.

Hack: Track days with apps like this Google Sheet (explained below)—aim for 11 months abroad.

How the trio compares

Country | U.S. Tax Interaction | Local Tax on Foreign Income | Strategic Advantage |

|---|---|---|---|

NYC baseline | Full U.S. tax + state/city | N/A | High income, high drag |

Panama | FEIE eligible | 0% (territorial) | Simple, low-cost arbitrage |

Cyprus | FEIE + FTC eligible | 0% on dividends/interest under non-dom | EU access + asset optimization |

Empathy note: The IRS shadow looms—this is normal. Start with a Greenback Expat Tax consult to sleep easy.

Subscriber spotlight

Jordan's Panama FIRE Pivot

Jordan H., 50, FIRE-minded consultant from NYC’s Upper East Side, hit financial independence on paper — but not in practice. Between co-op fees, state taxes, and rising living costs, withdrawals felt heavier than expected.

Panama City became the reset. A $1,700 one-bedroom in Casco Viejo, territorial taxation, and a dollarized economy flipped the math. With foreign-sourced income untouched locally and FEIE reducing federal exposure, Jordan redirected over $20,000 per year back into investments.

“Panama didn’t make me richer overnight,” he says. “It stopped the bleed.”

Jordan’s blueprint: FEIE eligibility established in year one (filed with professional support), Panama’s Friendly Nations residency pathway, and a carefully managed U.S. footprint. Mid-tier magic: Casco Viejo living at ~$1,800/month (vs. NYC ~$5,500) comfortably supports a ~$40k annual drawdown while preserving long-term optionality.

Cyprus: the EU non-dom alternative

Cyprus quietly offers one of Europe’s most compelling tax frameworks for Americans — especially those with dividends, interest, or business profits.

Under Cyprus’ non-dom regime:

Dividends and interest are taxed at 0%

No wealth tax

No inheritance tax

English widely spoken

EU residency and banking access

Living costs remain far below Western Europe, with $2,300–$2,800/month supporting a comfortable lifestyle in cities like Limassol or Paphos.

Cyprus isn’t a low-effort play — it requires residency setup and planning — but for asset-heavy earners, it delivers EU legitimacy without EU-level taxes.

Deep dive

What is FEIE

FEIE stands for the Foreign Earned Income Exclusion, a U.S. tax provision under Internal Revenue Code Section 911that allows eligible American expats to exclude a portion of foreign-earned income from U.S. federal income tax. The exclusion limit is indexed annually for inflation (for example, $126,500 for tax year 2025).

For qualifying remote workers or self-employed individuals living abroad, FEIE can significantly reduce federal tax liability on earned income. State taxes may still apply, depending on domicile and residency rules.

Quick Eligibility & How It Works

Qualify via:

Physical Presence Test — at least 330 full days abroad in any consecutive 12-month period, or

Bona Fide Residence Test — established residence abroad for a full tax year

Applies to:

Wages, salaries, and self-employment income

Does not apply to passive income such as dividends, interest, or capital gains

File:

Form 2555 with your federal tax return (Form 1040)

Can be filed using major tax software or with professional assistance

Document everything:

Passports, entry/exit records, leases, and travel logs

Consistent documentation is essential if the IRS requests substantiation

FEIE Excludes up to six figures of earned income from federal tax, can materially lower effective tax rates for expats, and provides a flexible qualification window (rolling 12-month periods allowed).

Important: FEIE and the Foreign Tax Credit generally apply to different income categories and cannot be claimed on the same income.

Risk & Audit Reality Check

FEIE is widely used and legitimate when filed correctly, but attention increases with complexity.

Common triggers include:

High total income (especially well above the exclusion limit)

Unreported foreign bank or investment accounts

Inconsistent or poorly documented days abroad

While overall audit rates remain low, the most common follow-ups are documentation requests, not full in-person examinations. Accurate records and consistent filings materially reduce risk.

Bottom line

FEIE is a powerful tool — not a loophole. it pairs well with jurisdictions that limit or exclude local taxation of foreign-sourced income.

Premium resource (free!)

FEIE progress tracker

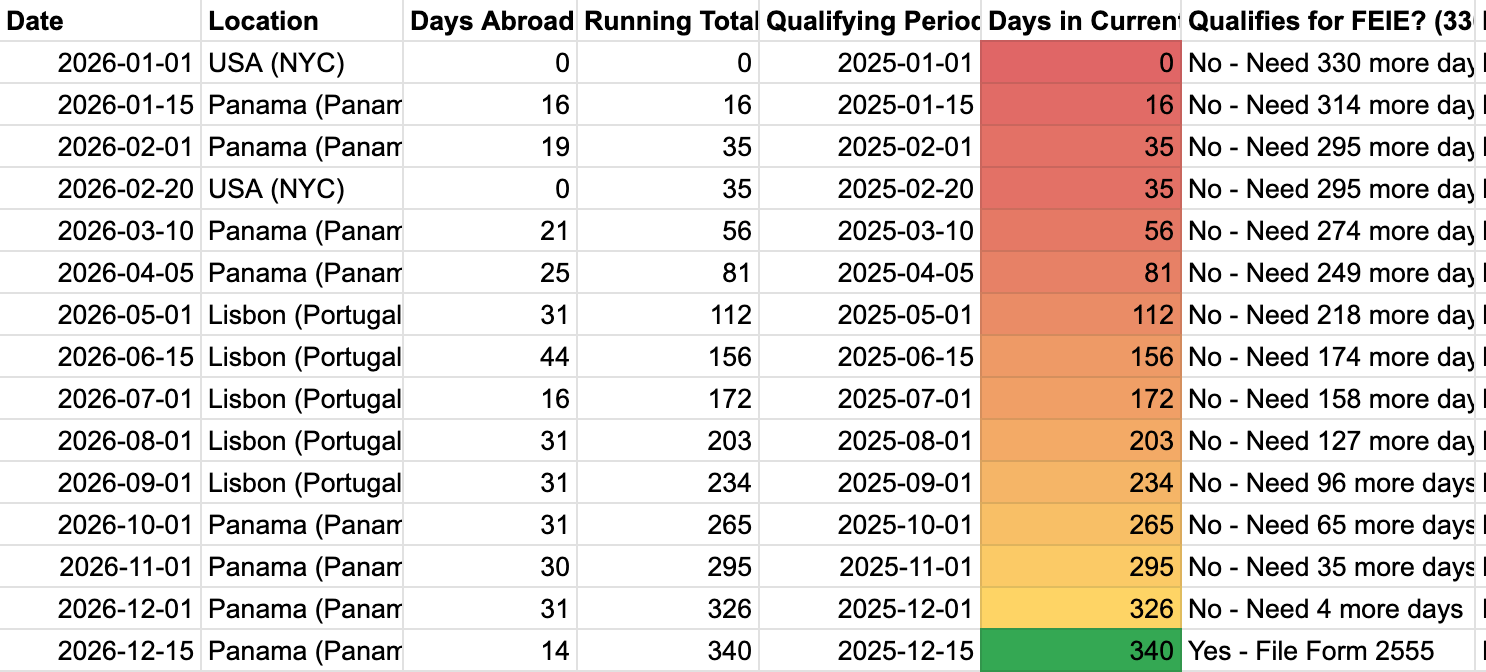

Use this Google Sheet to plan and monitor FEIE eligibility over time. It is designed to:

Track days abroad year-to-date for visibility

Track rolling 12-month windows, which the IRS allows under the Physical Presence Test

Help identify the earliest qualifying window for filing Form 2555

This tracker is especially useful for mid-year movers, slow travelers, and people splitting time between multiple countries.

How the FEIE 330-Day Rule Actually Works

Eligibility under the Physical Presence Test does not require the 330 full days abroad to fall within a single calendar year.

Instead:

The IRS allows any consecutive 12-month period

That period can span tax years (for example, October 2026 through September 2027)

You may choose the 12-month window that works best, as long as it includes at least 330 full days outside the U.S.

This flexibility makes FEIE practical for:

Mid-year relocations

Country hopping (e.g., Panama + Cyprus)

Staggered exits from the U.S.

Pro Tip: Track multiple rolling windows in parallel, then choose the strongest qualifying period when filing. This minimizes risk and maximizes coverage if travel patterns change.

You file one Form 2555 per tax year, selecting the qualifying 12-month period that supports that year’s exclusion. You do not file multiple Forms 2555 for overlapping windows in the same year.

Final compliance notes

“Full day abroad” means midnight-to-midnight outside the U.S. Partial travel days do not count.

Keep independent proof: passport stamps, flight confirmations, leases, utility bills.

Avoid publishing or implying exact “safe” U.S. visit patterns — intent and documentation matter.

Secure your abroad setup

Stay Connected, Stay Safe: NordVPN for Expats on the Move

Staying connected abroad means dodging hackers, geo-blocks, and spotty WiFi—NordVPN's got your back ($4/month basic plan, 6,000+ servers in 60 countries). Expat pros swear by it for seamless U.S. streaming in Panama cafes or banking logins from Lisbon balconies, all with military-grade encryption to protect your remote gigs from prying eyes.

Mask & Unblock: Hide your IP to access Netflix U.S. or company VPNs without hassle.

Expat-Proof Speed: 5,000Mbps+ on WireGuard—lag-free Zoom from anywhere.

No-Log Privacy: Audited zero-logs policy keeps your data yours, even on public hotspots.

Feel secure emailing clients from beach WiFi!

Your turn

Which arbitrage calls?

Reply with "Panama taxes" or "Cyprus life"—it will fuel future newsletters. Subscribe for the series: abroad blueprints to unlock your freedom.